KSHB 41 reporter Grant Stephens covers stories of consumer interest. Share your story idea with Grant.

—

The holidays may be winding down, but one expert says this is exactly when credit card debt sneaks up on you. Now's the time to take a hard look at how you're spending and borrowing.

The holidays come with a cost, and if you're one of half of all Americans, you're carrying that debt into the new year.

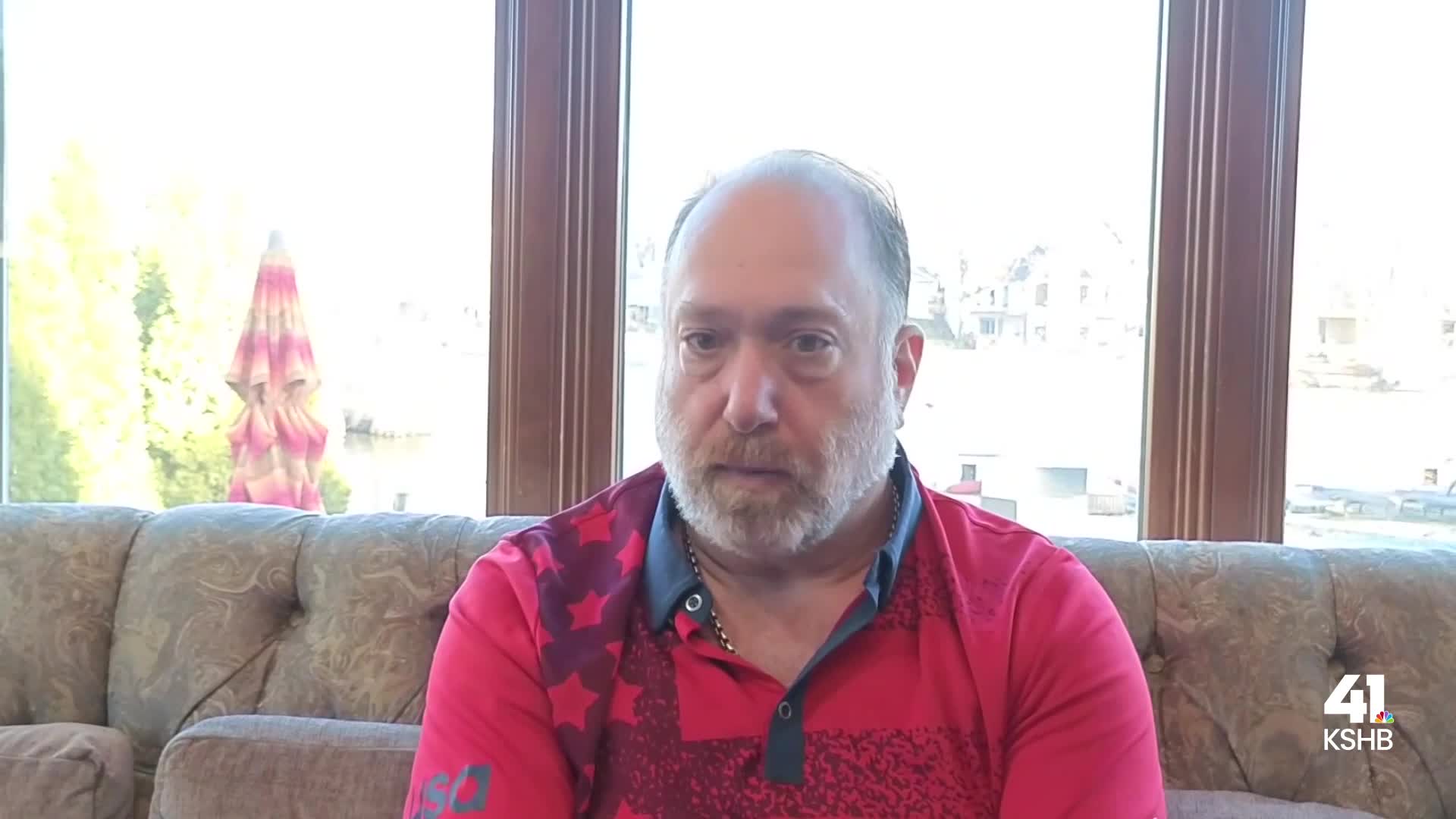

I talked to a local finance expert about helping people make some financial New Year's resolutions.

“For the normal, everyday person, what I would say to them is high-interest credit card debt is probably the worst thing on the planet. You're getting interest added daily," said Alan Becker, of RSG Investments. “Don't do it at the cost of yourself. Don't steal from yourself, meaning still put into your 401k.”

Becker zeroed in on tackling debt you built up over the holidays, paying that down before interest adds up in the next year.

He also warned about spending beyond your means, which has gotten easier with the rise in buy now, pay later services.

“What that is, is technology that is a digital version of layaway," Becker said.

Buy now, pay later services are becoming more and more popular because they're targeted to a younger audience and they're easy to use. A fifth of all U.S. adults used them in the last year.

This story was reported on-air by a journalist and has been converted to this platform with the assistance of AI. Our editorial team verifies all reporting on all platforms for fairness and accuracy.

—