KSHB 41 reporter Charlie Keegan covers politics on both sides of the state line. If you have a story idea to share, you can send Charlie an email at charlie.keegan@kshb.com.

—

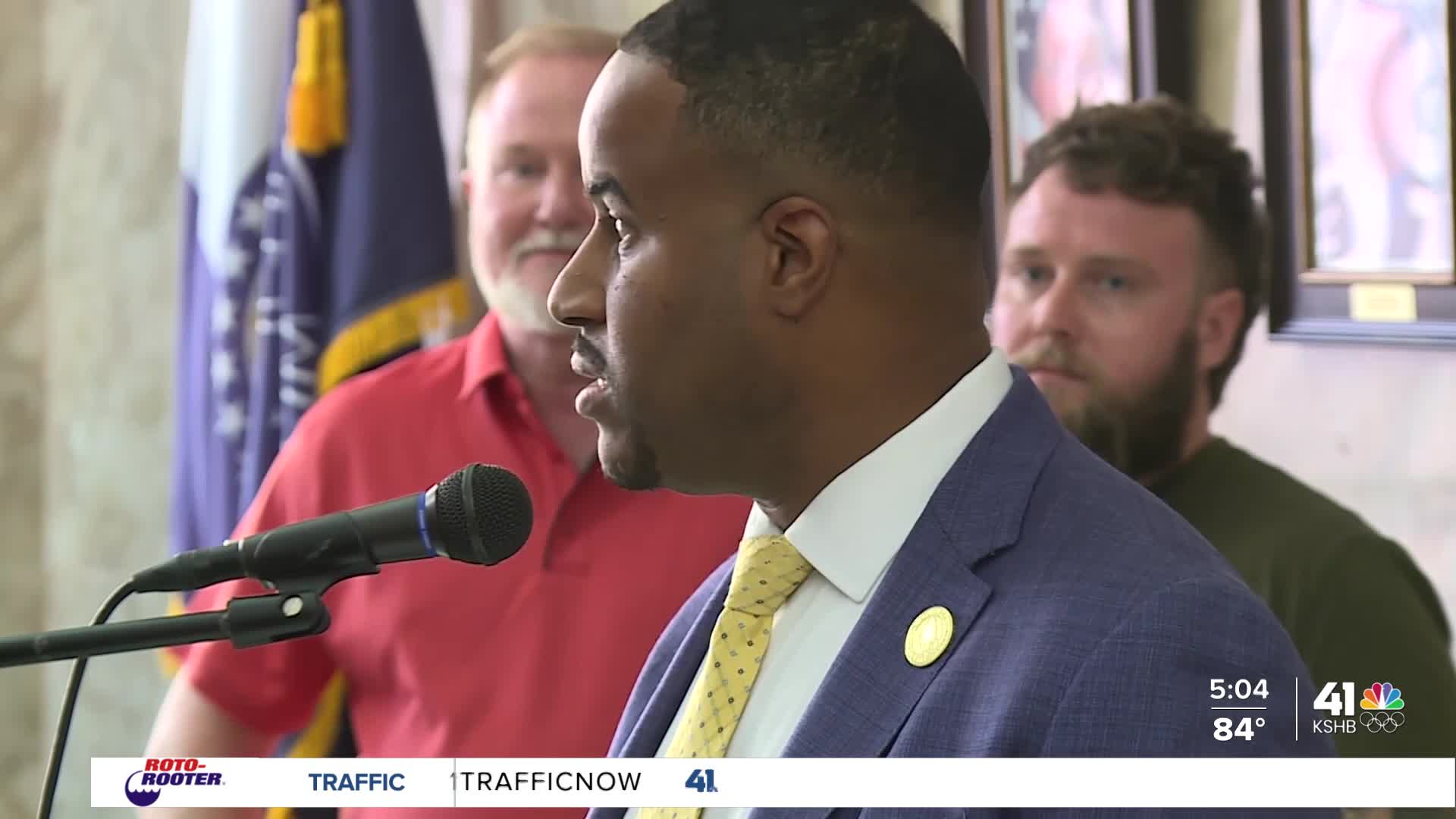

Interim Jackson County Executive Phil LeVota detailed changes to the county's property tax assessments process during a news conference Friday afternoon.

The changes retroactively place a cap of a 15 percent increase on commercial properties whose values rose by more than 15 percent in 2025 compared to 2024.

The new policy only applies to properties with a value of less than $5 million in 2024.

Reducing a property’s assessment should reduce the amount the owner pays in property taxes.

“The people need relief and we’re giving them relief,” County Executive Phil LeVota said.

LeVota detailed the changes during a 3 p.m. news conference, which you can watch below.

Jackson County records show the average commercial property increased by 24 percent in 2025.

Alongside LeVota’s action, the county legislature will introduce a resolution at Monday’s meeting codifying the County Executive’s approach.

“This is how we send a clear message that Jackson County is now open for business,” said Chair of the Legislature DaRon McGee.

Greg Walters owns a commercial property that increased by 75 percent in 2025.

“This year it’s been a ridiculously high increase,” Walters said.

He saw his residential property increase by 58 percent in 2023. Walters would like LeVota to focus on both commercial and residential relief.

“I think it should be all inclusive,” Walters said. “I don’t want to see it just going to certain segments or certain areas. It should be for everybody. What’s sauce for the goose is sauce for the gander.”

LeVota promised that residential property assessment reform is next on his agenda. He did not offer a timeline.

There is a fear that the changes to this year’s commercial assessments will negatively impact schools, libraries, and other agencies that rely on property tax dollars, as they’ve already set their tax rates based on current assessments, not the changes the county now plans to enact.

“If you don’t have taxpayers paying property tax at all because we’ve driven them out by such high increases, you’re not going to have schools anyway. At this point, we’re trying to find a balance,” countered Legislator Manny Abarca.

Owners of qualifying commercial properties do not need to contact the county. LeVota said staff within the county will identify the properties and make appropriate changes.

—