KANSAS CITY, Mo. — A recent Yahoo Finance poll shows the vast majority of consumers are worried about their personal finances.

The trend of worry isn't hard to localize - people all over the metro say they've been stressed about money too.

It may not be a surprise at this point what the top pain points are; Inflation, tariffs, housing cost, and interest rates.

There's been a steady climb across the board over the years and Kansas Citians feel the squeeze from all sides.

“Especially now. The school year’s getting started," Ismael Berlanga said as he waited outside KC's Rivermarket.

He says he started stocking up early to avoid potential tariff price hikes on things he knew he'd need.

“A few months ago we went ahead and front-loaded a lot of things we knew that we were going to need," he said.

"Stocked up early and then sure enough started to see prices increase so we’ve been cutting back on some of the extras. Maybe not doing as much, maybe not eating out as much.”

Looking at groceries, eggs have seen the most fluctuation in price over the last year for a multitude of reasons, but are currently sitting about a dollar more expensive than they were this time last year.

In general, prices aren't spiking sharply on most goods, but the prolonged across-the-board minor increases have stacked up.

“I think I’m fortunate enough to feel pretty secure but it does feel like there’s a bit of a shift in the economy, perhaps trending in the wrong direction," downtown KC resident Kasey Youngentob said.

“If anything there will be more uneasiness moving forward.”

The sentiment that things aren't going to get better anytime soon is echoed by economists, and northland resident Donovan Comer.

“Money gets tight and everything is going up so it’s getting really, surviving by the skin of your teeth," he said.

Housing cost has been his top concern. Looking at the data it's easy to see why.

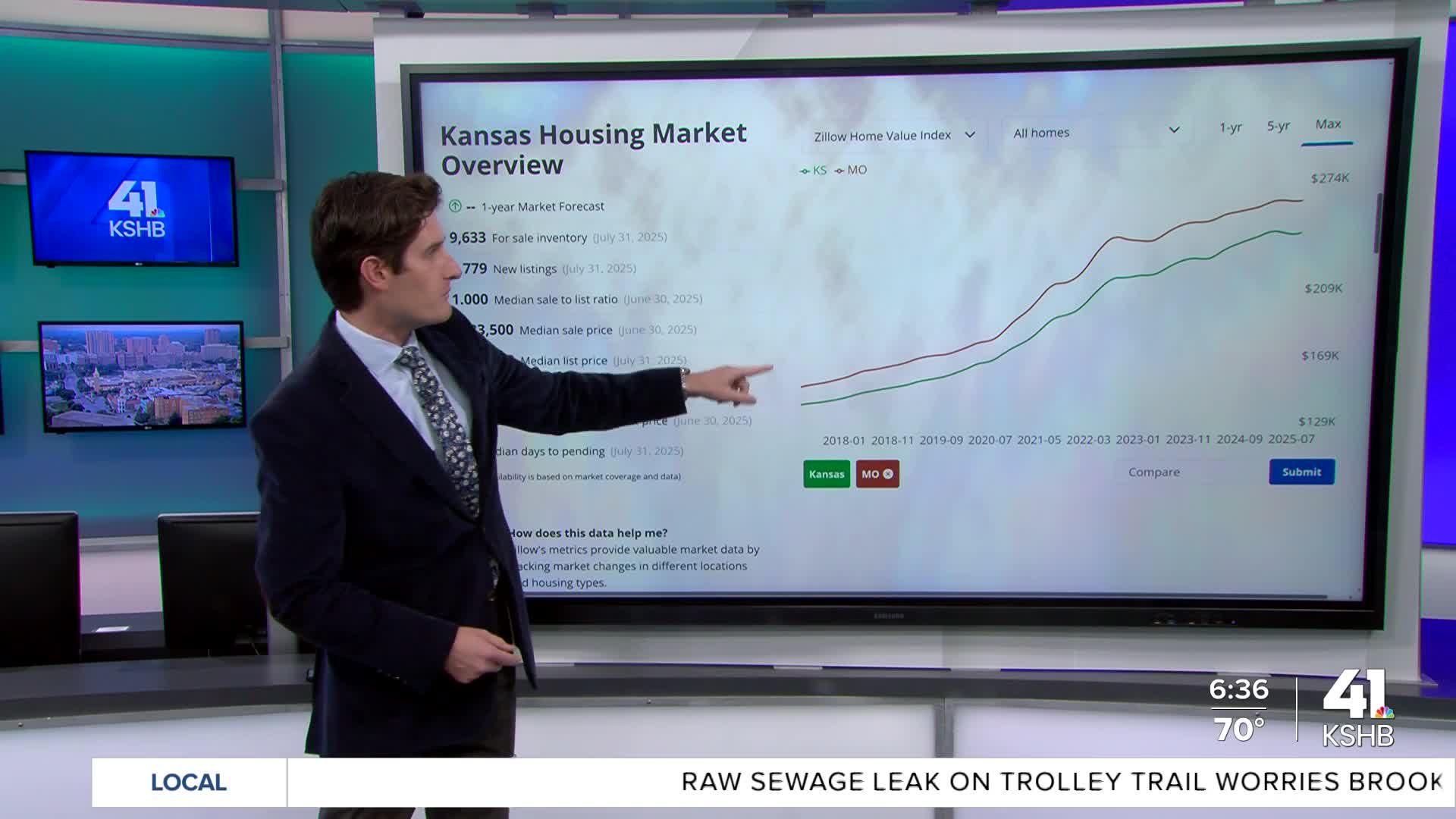

Right now housing prices in Kansas and Missouri are up about 2.5% from this time last year, according to Zillow.

It might not seem like much but remember, those increases are built on top of other increases from years prior. Rewind only five years and the average price of a home in Kansas or Missouri was about $100,000 less.

“With everything going on in the world right now and everything that’s happening, I’m not either in a hopeful or despondent state ... it’s a more unknown state. Like what’s going to happen?"

KSHB 41 reporter Grant Stephens covers stories involving downtown Kansas City, Missouri, up to North Kansas City. Share your story idea with Grant.