WYANDOTTE COUNTY, Kan. — Leaders in Wyandotte County have decided to increase the maximum mill levy rate, which determines how much homeowners pay in property taxes.

Last year, the county went revenue-neutral, so the county wasn't able to collect more property taxes than the year before. However, that put county staff in a difficult spot to balance the budget.

"We have infrastructure needs, we're seeing a decrease in crime, and we want to keep that momentum up," Unified Government Chief Financial Officer Shelley Kneuvean said. "We don't want to cut back on public safety."

But an increase in property taxes would put many residents, including seniors, in a tough financial spot.

"What good a benefit is it to me if I can't afford to pay my taxes?" resident Beatrice Huskey said. "I'll lose my home."

Wyandotte County faces a significant budget deficit in the upcoming year, which prompted commissioners to consider increasing the mill tax rate.

"The can has been kicked and kicked down the road, and the can has stopped at us," Unified Government of Kansas City, Kansas, and Wyandotte County Mayor Tyrone Garner said.

In a 7-3 vote on Wednesday night, Wyandotte County leaders voted to exceed the revenue-neutral rate by about three mills in the county and city. That could increase property bills by about $144 for a home valued at $200,000.

"I have sympathy for the [homes] that are going on sale because people cannot pay their taxes anymore," resident Fred Postlewait said.

If leaders didn't increase the max rate, the county would have faced a budget shortfall of about $9 million, threatening cuts to public services like police and fire.

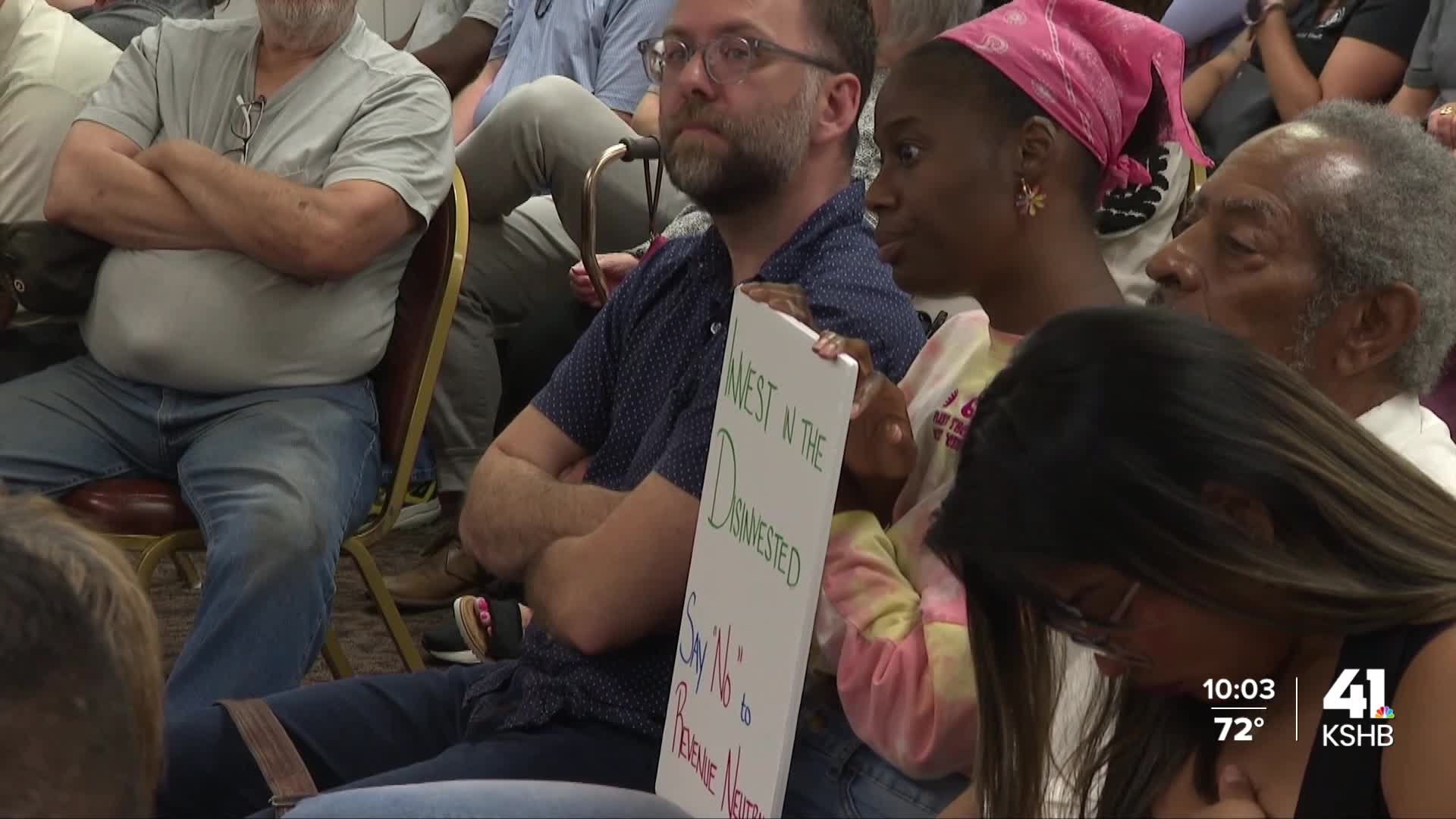

"The Northeast always gets hit the hardest when these things happen," resident Nikki Richardson said. "I wanted to make sure that we invest through the community that was getting hit the hardest."

Some residents like Richardson aren't excited by higher property bills, but welcome a levy hike if it means more funding for their neighborhood.

"The hard reality is that property taxes were going to increase anyway," Richardson said.

According to the county staff's presentation at the meeting, raising the tax rate to 37.4 mills could increase the tax revenue by about $10.5 million.

"That's more of an increase than we've seen in past years," Commissioner Tom Burroughs said.

Though the rate increase passed in a majority, some commissioners were adamantly opposed. They argued the money could come from a sales tax or revenue fund and not the taxpayers.

"If our expenses are that much, then we need to take a systemic approach to how we can have legacy fiscal stability in this budget," Burroughs said.

There will be a public hearing for the proposed tax rate increase on August 26.

The budget and the actual tax rate still have yet to be decided, and both are expected to happen in August.

—