KSHB 41 reporter Olivia Acree covers portions of Johnson County, Kansas. Share your story idea with Olivia.

—

Changes to federal taxes could mean bigger refunds for millions of Americans, especially seniors and tipped workers. For the salon industry, these changes represent the culmination of decades of lobbying efforts. I wanted to hear how this will affect tipped workers in our community.

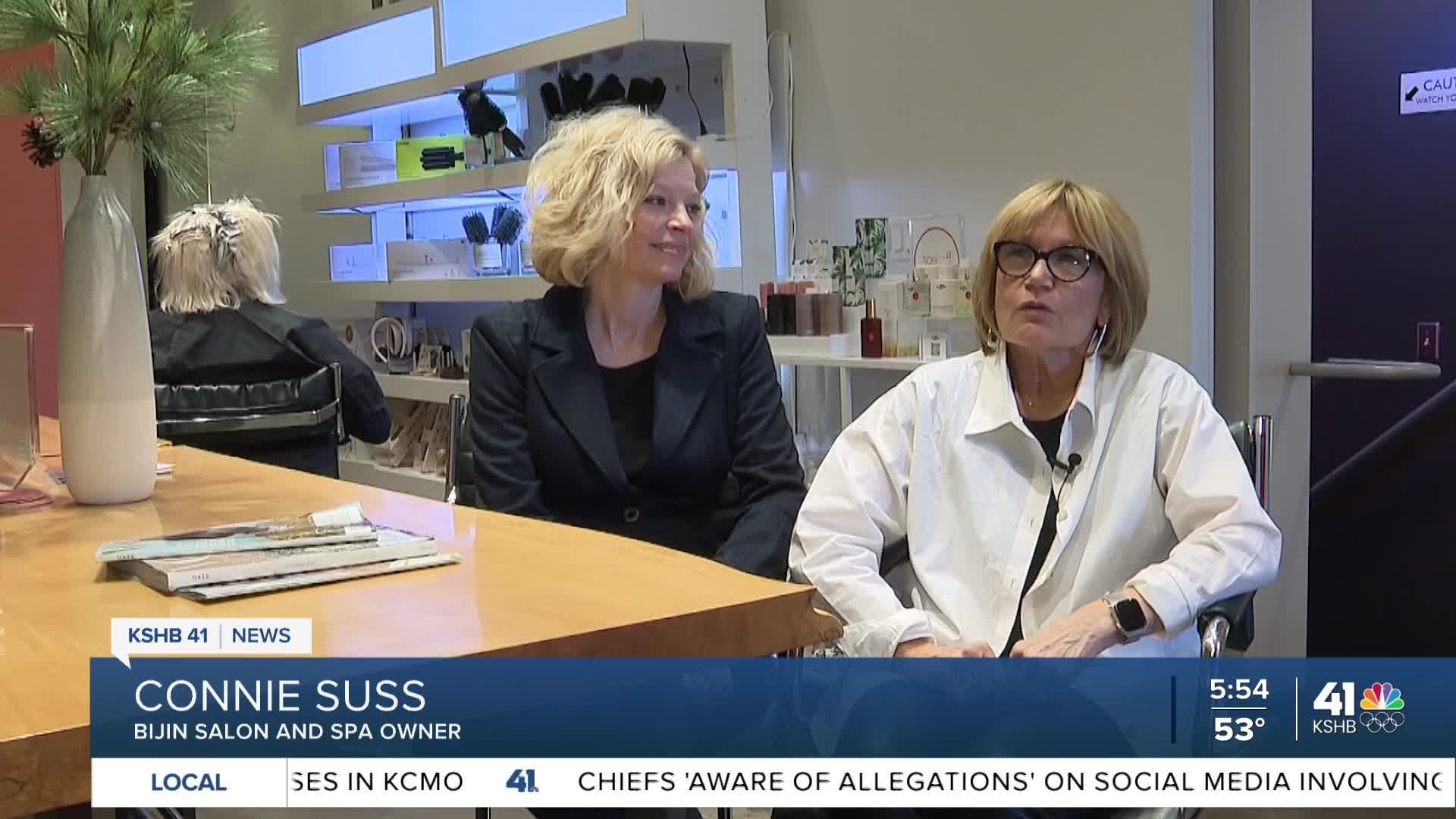

Until now, the tax season reality for Connie Suss, who owns Bijin Salon and Spa in Prairie Village, has been paying taxes on her business and her employees' tips.

"The Pro Beauty Association, they've been lobbying this for about 15 to 20 years," Suss said.

The changes they've been lobbying for include no federal tax on tips and FICA tip tax credit for salon owners.

"Realize that it's a gift, that it's not part of the actual service that the salon is collecting for," Suss said.

Suss says the industry is often forgotten in this conversation, even though tips can make up a large portion of their income. However, changes from the Big Beautiful Bill mean that for the first time ever, salon owners will get the same tax credit that restaurant owners have had since 1993.

"This is a not only a win for the industry employees, but also the business owners," Suss said.

Tax experts say that no tax on tips comes with a little added work when employees file for 2025.

"For this year, a lot of it's going to be gathering the information," said Bruce Snyder, an assistant accounting professor at UMKC.

Snyder explained that for 2025, tipped employees can deduct up to $25,000. That's only if they've reported those tips.

"I won't say that, you know, people are not reporting their tip compensation, but I'm sure it happens from time to time. So there's no deduction on tips if you don't report the income," Snyder said.

At Bijin, Suss hopes full reporting helps raise the bar for the industry.

"If people aren't reporting their full income, then it doesn't look like it's maybe a career that you want to send your child to school for. We experience that a lot," Suss said.

The Professional Beauty Association advocated for the passing of these two laws for years. I reached out to them for comment and they told me "pairing no tax on tips with the FICA tip tax credit was essential. As service providers are incentivized to report tip income accurately, salon owners need assurance that doing so will not increase their tax burden."

They also told me they support the possibility of keeping no tax on tips in place past 2028.

This story was reported on-air by a journalist and has been converted to this platform with the assistance of AI. Our editorial team verifies all reporting on all platforms for fairness and accuracy.

—