KSHB 41 News anchor Taylor Hemness reports on stories across Kansas, including a focus on consumer issues. You can contact Taylor by email.

—

I'll start with a confession: I have two items that I bought for Christmas this year that I decided to "Buy now, pay later." One was an online purchase, one in-store, but the gist is simple--pay a little bit today to get my item, then pay it off over time. Is that a good idea, or a bad one? A local economist told me, it can be both.

Aditi Routh is an economist with the Federal Reserve Bank of Kansas City, and I chatted with her about BNPL plays yesterday, as people decide on those last-minute gifts. Here are things she told me:

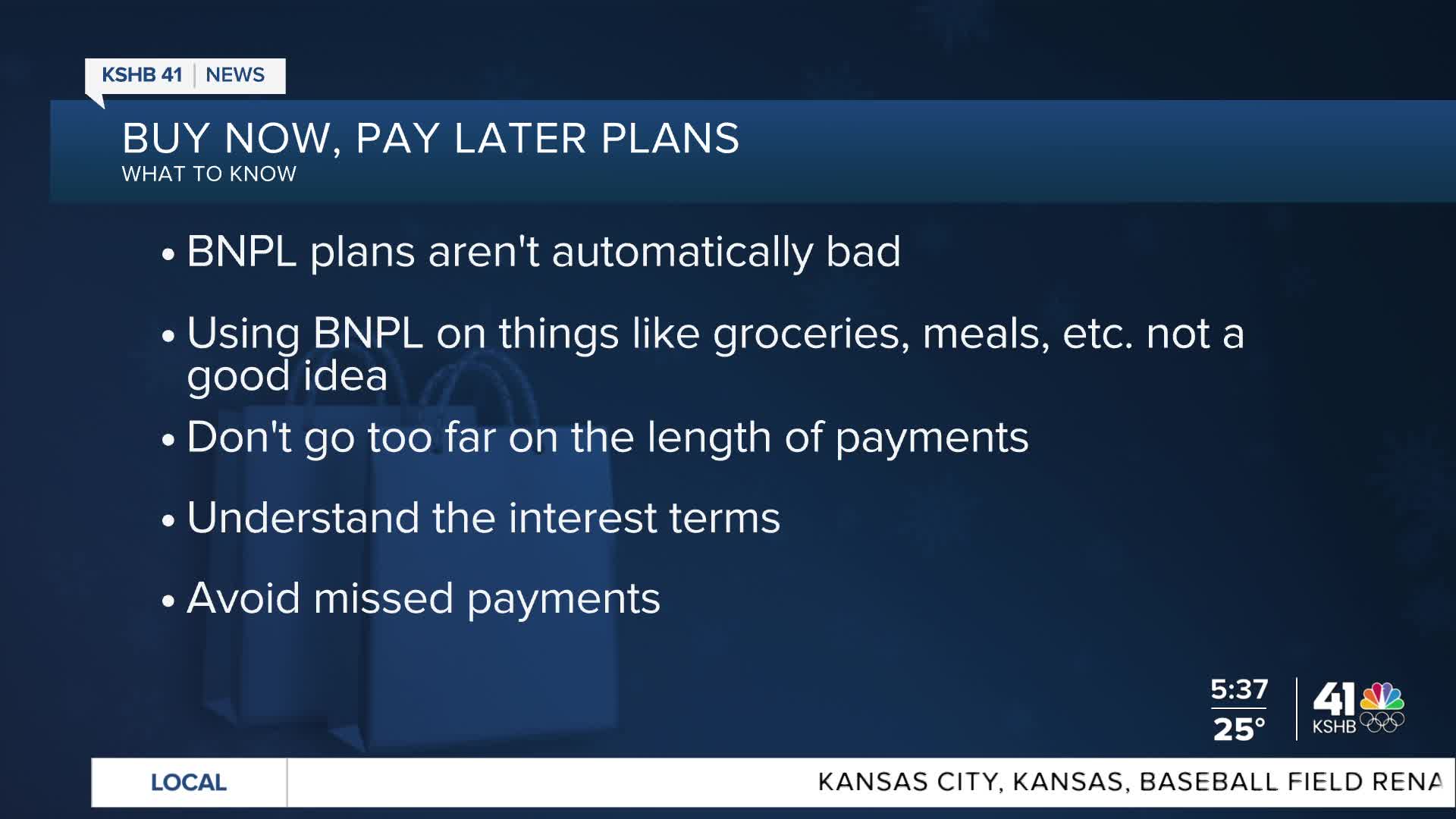

First, BNPL plans aren't automatically bad. They're in the market for a reason, and they can help some people fit more expensive items into their budget.

But, using them on things like groceries, meals, even DoorDash. is probably not the best idea.

Don't go too far on the length of the payment. You don't want to be paying for this year's Christmas gifts next year when it's time to buy again. Good rule of thumb: If you can pay it off in four payments, or in six weeks or less, that's ideal.

That means you also need to understand the interest terms on these plans. Shorter pay-off periods like this are less likely to include any interest. Longer plans will likely mean paying interest.

And finally, Aditi says they are seeing a trend of more people making late payments on BNPL plans. In June of this year, FICO announced plans to start incorporating retail BNPL into your credit score. The last thing you want is to have missed payments on a bunch of gifts and cause your credit rating to drop.

—