KANSAS CITY, Mo. — With the Federal Reserve cutting interest rates, you may be wondering how this will impact you and your finances. Well, we spoke with local experts to get you those answers.

The Fed lowered its benchmark rate from 4.25% to around 4% — the first cut since late last year.

While the reduction may seem modest, real estate professionals are already anticipating significant market changes.

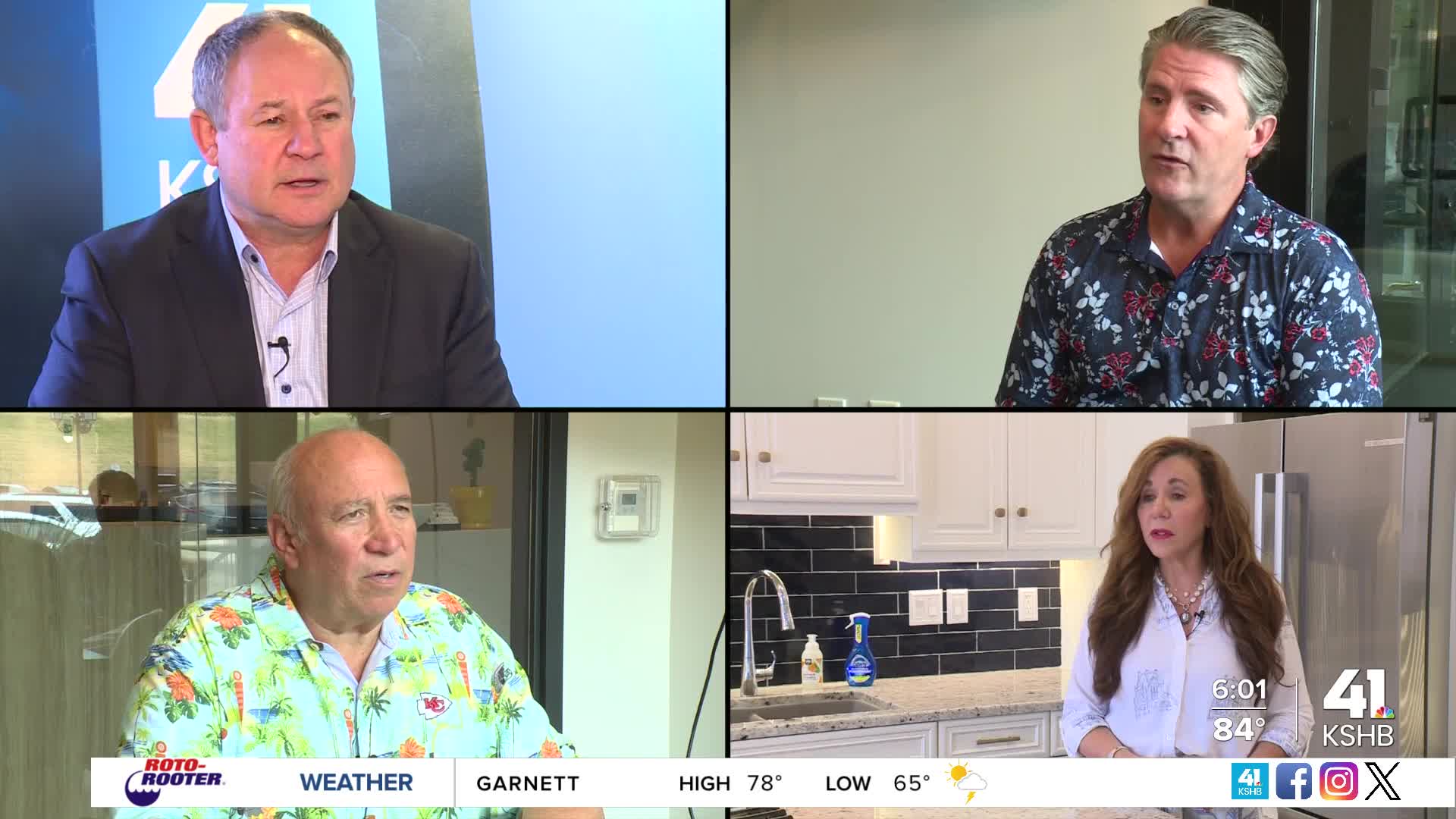

Sharon Aubuchon, a realtor with Remax Premier, said the timing could be crucial for both buyers and sellers.

"We don't think they're going to drop crazy low. We think it'll be low sixes, but we could be wrong," Aubuchon said. "But again, if it does, it's going to be a bidding war frenzy. So if you're thinking about selling, jump on that train and run with it, but if you're buying, it's not a train ride you want to be on."

The rate cut has already affected mortgage rates, according to realtor George Medina.

"The rates I've seen, they've been like from seven and a quarter, and now they're closer to 6%," Medina said. "So that's going to get a lot of people out in the market and start looking at possibly buying a home."

However, consumers shouldn't expect instant relief across all borrowing categories.

Scott Colbert, chief economist at Commerce Bank, said you may not feel the impact immediately.

"Not a lot at first," Colbert said. "To the extent that you're borrowing any money based on short-term interest rates, they will immediately fall by probably 25 basis points. Those might be people with home equity loans, credit card loans, auto loans, [which] may be a little cheaper."

The rate cut comes as the Federal Reserve grapples with economic challenges, including a sluggish job market.

Stephen Tremaine, a mortgage branch manager, noted the cyclical nature of rate adjustments.

"They're going to lower those rates when the economy is not doing good," Tremaine said. "Then, when the economy starts doing better, because of the lowering of the rates, then mortgage rates will go up."

Federal Reserve Chairman Jerome Powell has indicated two additional rate cuts could occur before the end of the year, potentially providing further relief for borrowers.

—

KSHB 41 reporter La’Nita Brooks covers stories providing solutions and offering discussions on topics of crime and violence. Share your story idea with La’Nita.