KSHB 41 reporter Elyse Schoenig covers the cities of Shawnee and Mission. She also focuses on issues surrounding the cost of health care, saving for retirement and personal debt. Share your story idea with Elyse.

—

UPDATE, Friday, Nov. 14 | During an open enrollment session Friday for retired Olathe city employees, city officials announced they will provide a $250 per month subsidy for certain health insurance plans.

"The City Manager's Office understands that changes to the retiree health insurance plan for 2026 were shared with less than advance notice than many would have preferred, and we recognize that this has caused undue frustration and stress," the city said in a notification Friday to retirees.

ORIGINAL REPORT | As families across the Kansas City area compare health care plans during open enrollment, some retired Olathe city employees are grappling with skyrocketing premium increases they say threaten their retirement security.

A retired city employee reached out to KSHB 41 about changes to Olathe's retiree health benefits. At the most recent Olathe City Council meeting, several retirees said the city's health insurance premium increases could raise their health care costs by 500% to 900% in 2026, depending on their plan and coverage level.

Retired Olathe Deputy Fire Chief Todd Hart said he's moved his 31-year service plaque from his wall to his basement — a symbolic gesture representing his feelings about preparing for a 500% increase in his health care costs from the city.

"All of a sudden, now you're just going to break it off on the backs of the employees or the retirees?" Hart said.

Hart said the premium increases mean his wife will have to move to the Affordable Care Act marketplace, while he said he'll switch to a city plan that was once $80 a month but will now cost close to $500 monthly.

Hart's frustration stems from what he sees as a recurring pattern. In 2005, he says he helped lead a city task force that developed alternatives to increasing health insurance premiums.

"We identified in 2005 that we had an issue," Hart said. "In 21 years, nothing has changed."

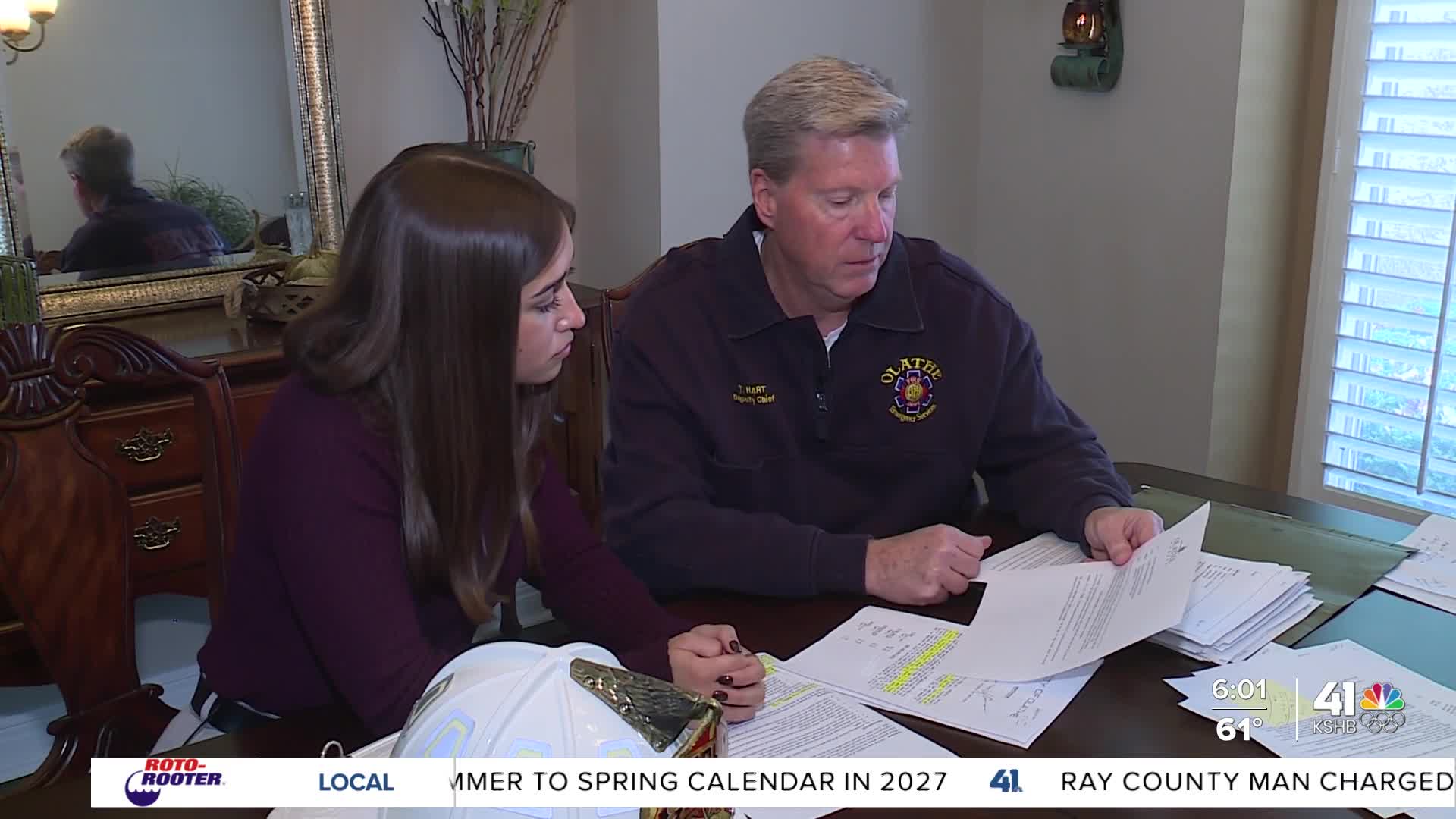

Hart showed documents from the task force that came up with alternatives to premium increases, but he said nothing came of those ideas.

City of Olathe spokesperson Cody Kennedy said the city is not immune to costs rising everywhere.

"This is really the first time in a number of years that outside economic factors have really influenced as sharp of an increase as this," Kennedy said.

Kennedy acknowledged the impact on both retirees and current employees.

"We understand that retirees have limited income. We also understand that employees have certain things they've got to pay for with children and all of those costs as well," Kennedy said.

Kennedy noted the city's insurance rates remain lower than what state statute sets, which allows employees to retire early.

Hart said the situation sends a troubling message to current employees and makes him feel devalued after three decades of service.

"What are you telling the people that are working there today?" Hart said. "I feel like I'm just a number."

He describes the increases as unsustainable, but maintains hope for change.

"This is absolutely ridiculous. This is not sustainable," Hart said. "Holding out hope that the city does the right thing."

In an email obtained by KSHB 41, the city extended its enrollment window to December 3rd for retirees facing these premium increases.

Kennedy also pointed to free resources available to help mitigate increased premiums, including a well-being center for physical and wellness visits and a bundle service for routine surgeries and care.

Comparison with neighboring cities

Other Johnson County cities handle retiree benefits differently. A Lenexa spokesperson said their retirees receive coverage when they retire, with costs increasing only slightly.

In Overland Park, a spokesperson said retirees get health and dental insurance based on their years of service. KSHB 41 reached back out for additional details about costs and any increases in these cities.

This story was reported on-air by a journalist and has been converted to this platform with the assistance of AI. Our editorial team verifies all reporting on all platforms for fairness and accuracy.

—