KSHB 41 reporter Charlie Keegan first learned of this story while attending a town hall event in February. You can read his follow-up report below. If you have a story idea to share, you can send Charlie an email at charlie.keegan@kshb.com.

—

The motto for Rich Hill, Missouri, is “the town that coal built.” The town flourished during a boom in coal mining during the late 1800s and early 1900s.

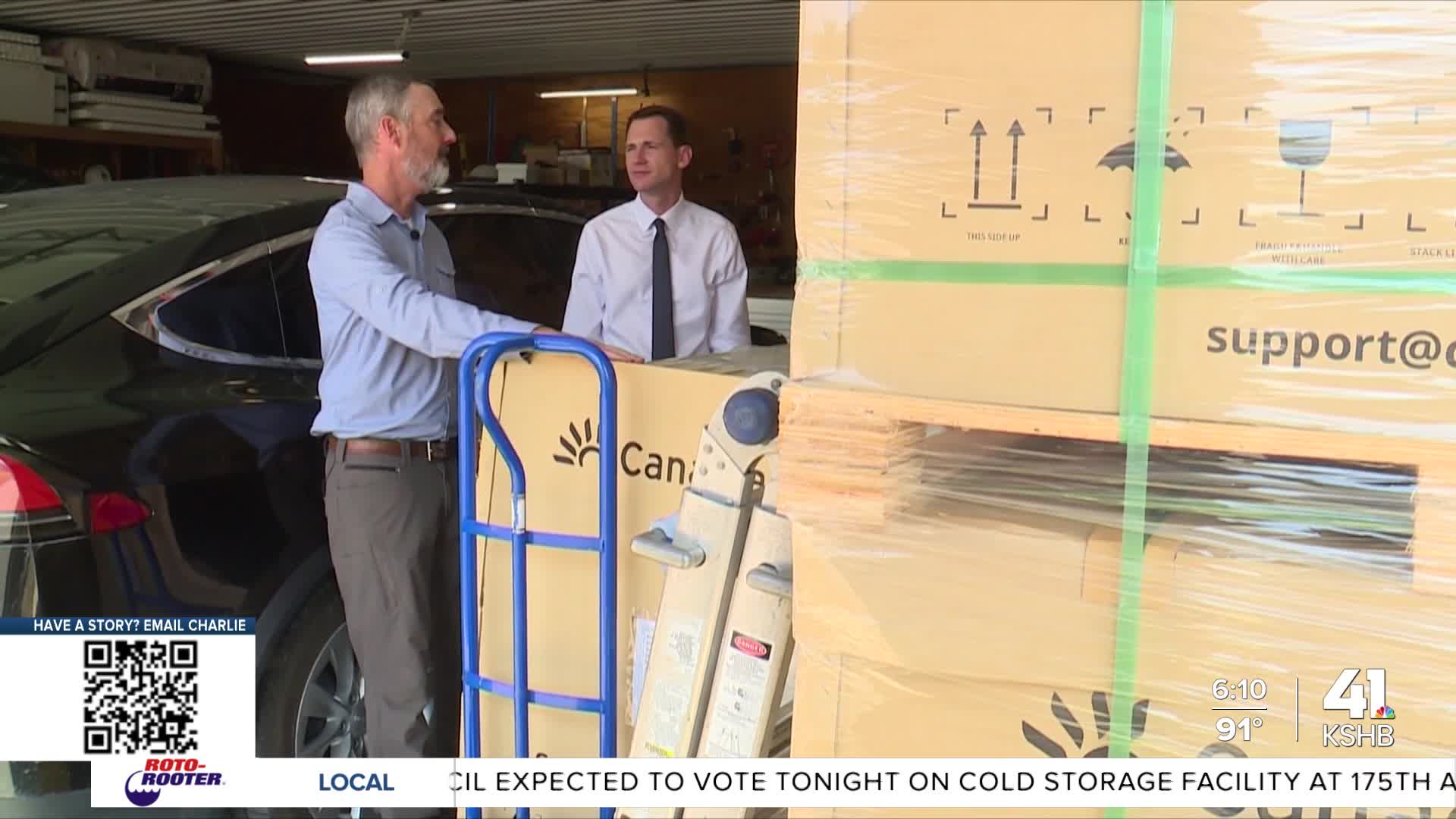

In 2012, Jeff Droz opened Roof Power Solar, a solar panel installation company, in the city. Just like the coal industry left the city, Droz is closing his clean energy company.

“There’s too much uncertainty on the whims of politicians,” Droz said.

As part of President Donald Trump’s "Big Beautiful Bill," the government changed the end date for a 30% federal income tax credit for individuals who buy solar panels.

The 48E Clean Energy Investment Tax Credit (ITC) was scheduled to expire in 2032. The Big Beautiful Bill closes the program in 2026.

Droz said the Trump administration also paused a solar energy grant program through the United States Department of Agriculture.

Because of the changes, there’s less incentive for people to buy solar panels.

Droz is closing the sales and installation part of his business, but he plans to continue working as a consultant. The small business owner laid off his last employee in March.

“I’ve had enough. I’m disappointed more people don’t speak up and say how it impacts them negatively personally,” said Droz, who did not vote for Trump.

The president posted on Truth Social in August that wind and solar programs are to blame for increased energy rates. He called them “the scam of the century.”

U.S. Congressman Mark Alford represents Rich Hill in Washington, D.C. He supported the Big Beautiful Bill.

At town hall events in the area last month, Alford said the law does more good than bad. Specifically, it extends income tax cuts from Trump’s first term.

“It would’ve been the largest tax increase in US history, [if we didn’t pass the law],” Alford told a crowd in Harrisonville.

Droz said he doesn’t regret opening his business. He admitted there is room for decreasing the tax incentives, but not eliminating them.

“It’s the rapid ups and downs, the roller coaster of it, that’s the problem,” Droz said.

—