KSHB 41 reporter Alyssa Jackson covers portions of Johnson County, including Overland Park, Prairie Village and Leawood. Share your story idea with Alyssa.

—

After a warning from Kansas Attorney General Kris Kobach, Johnson County voters won't have a ballot initiative to vote on in the November election to renew a 1/4th-cent public safety sales tax.

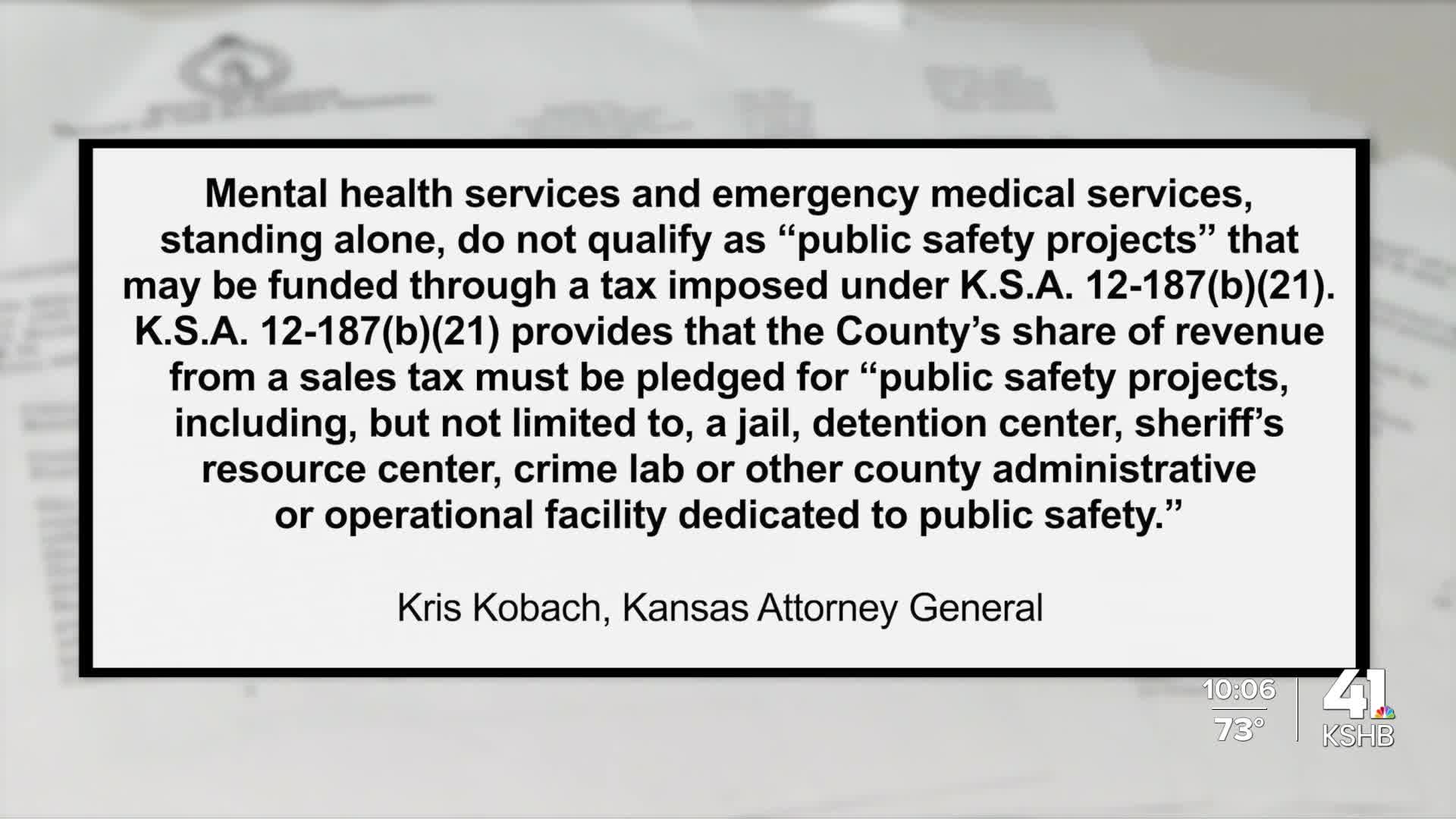

Kobach's legal opinion stated the current ballot language does not follow state law.

"The timing of this opinion comes as we are weeks away from sending ballots overseas to men and women in the armed forces and doesn't give us time to seek legal clarification," said Johnson County Board of Commissioners Chairman Mike Kelly.

Kansas State Senator Mike Thompson asked the attorney general's office to interpret whether the proposed sales tax is lawful.

Commissioner's approved the ballot language in May:

“Shall the Board of County Commissioners of Johnson County, Kansas, adopt, renew, and impose for a period of ten (10) years a one-fourth (1/4) of one-cent countywide retailers’ sales tax in Johnson County, Kansas, commencing April 1, 2027, with proceeds from the tax to be distributed as required by law to the County and the cities in Johnson County, with the county share to be used for the purpose of financing the costs of construction, renovation, repair, maintenance, operation and personnel expenses of public safety projects, facilities, and programs, including but not limited to emergency/ambulance/911 services, Sheriff’s Office, mental health crisis intervention, emergency preparedness/disaster response, and criminal justice system?”

"We've told the county they're on thin ice and we think they're gonna fall through the way we read the Kansas law," Kobach said.

The sales tax would raise an estimated $54 million each year. It's set to expire in 2027.

In an eight-page opinion, the attorney general's office stated that mental health services and emergency medical services don't qualify as public safety projects.

The attorney general's office compared Johnson County's 2016 ballot language, when voters approved the sales tax, citing that the extension would not be a renewal if the sales tax isn't being used for the same purpose.

Chairman Kelly said: "Public safety is sacrosanct. We won't sacrifice that. If Sen. Thompson and the attorney general want to take away the opportunity of the people of Johnson County to choose whether or not a public safety sales tax is a way to provide those services, they're advocating for raising property taxes."

The attorney general's opinion is not a legal action. However, his office said it's for taxpayers and the commission to consider.

"I don't have a dog in this fight," Kobach said. "I'm not a Johnson County resident, and it's up to the residents to decide if they want to impose this tax or not."

Since the county filed a declaratory judgment on Thursday, commissioners will wait for a judge to make a decision.

The election is tentatively rescheduled for March 2026.