KANSAS CITY, Mo. — The Olathe City Council is set to hold a public hearing and consider an ordinance next Tuesday to participate in a STAR bond district as part of the Kansas City Chiefs move to Kansas.

An agenda item posted Friday night indicates the council will be tasked with specifying a pledge of local sales and use taxes to help repay STAR bonds issued for the Chiefs project to build a $3 billion, fixed-roof domed stadium in Wyandotte County and a new $300 milllion team headquarters and training facility in Olathe.

Mayor John Bacon sent KSHB 41 News a statement Friday night about the upcoming meeting:

"Tuesday the Olathe City Council will hold a public hearing and consider an ordinance to pledge local incremental sales tax from the project area to the Chiefs headquarters and training facility project in Olathe," Mayor Bacon said in his statement. "This development provides a lot of potential benefits for our city, in the immediate area of where it’s being developed and beyond. I’m excited about the possibilities it brings to Olathe."

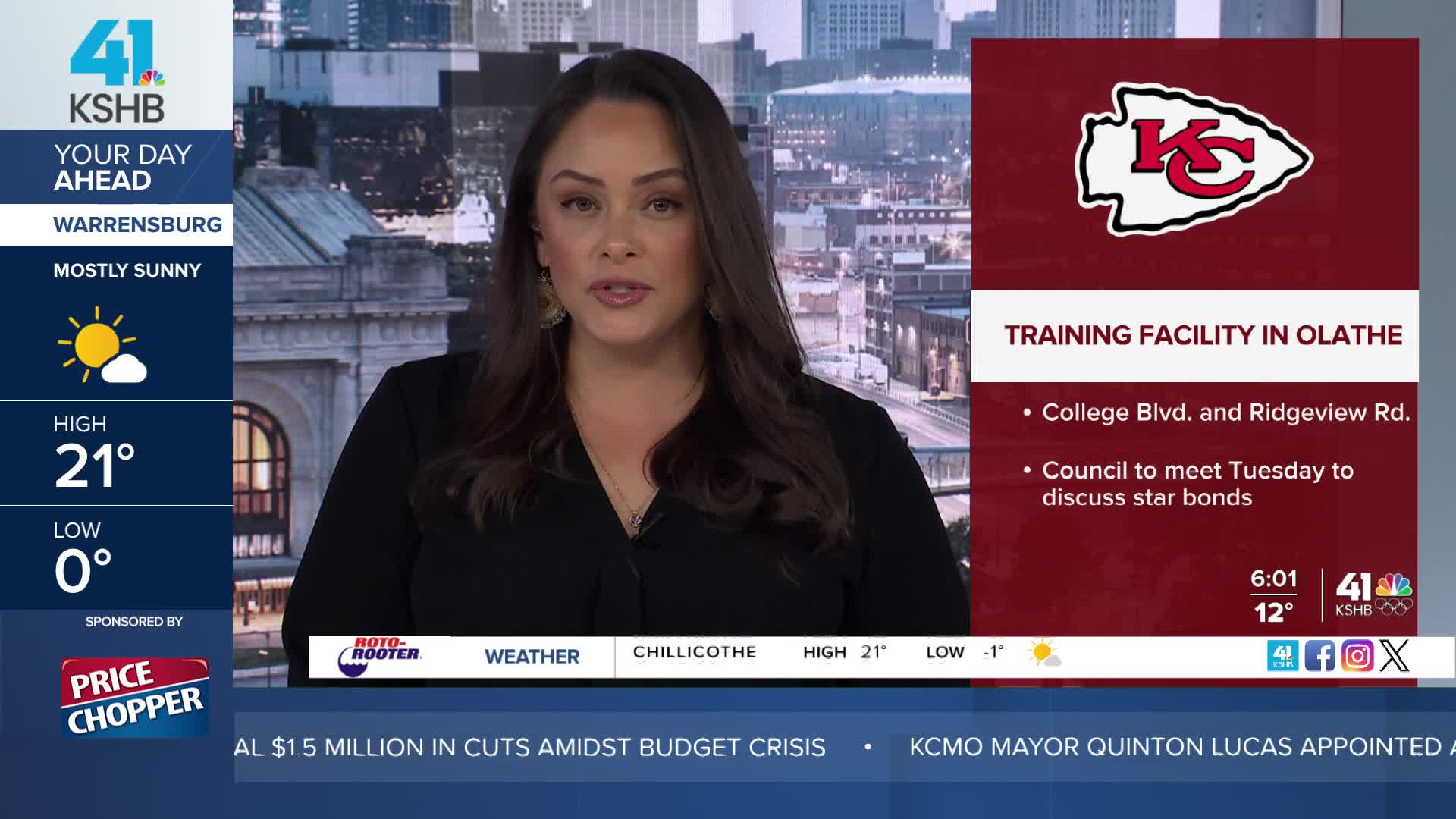

According to the agenda item, Olathe officials are exploring a 165-acre site at the northwest corner of College Boulevard and Ridgeview Road just south of Kansas Highway 10.

"The project will generate significant new capital investment in Olathe, with the total economic impact to be determined at a later date," city staff wrote in the proposed ordinance.

In late December 2025, the Chiefs announced they had reached a wide-ranging deal with Kansas leaders to bring the team across state lines. The plan includes a $3 billion, fixed-roof domed stadium in Wyandotte County and the construction of a new training facility and team headquarters in Olathe.

RELATED | Under wraps for 2 years: How Olathe successfully secured Chiefs headquarters deal

At the time of the announcement, the locations for all three facilities remained unknown.

Friday's announcement by Olathe helps settle the general location for the facilities there. The Wyandotte County location remains uncertain, though it is widely believed to be adjacent to the Village West area near Interstate 435 and Interstate 70.

The council will be asked to pledge the following new revenues from within the base revenue area above in green:

- For up to 30 years, all of the city's general sales and use tax that is not committed to other uses by election of voters or pledged to bond repayment (currently 1 percent) from within the area in green;

- For up to 30 years, all of the city's share (currently 17.63 percent) of the Johnson County sales tax that is not committed to other uses by election of voters or pledged to bond repayment (currently .5 percent) from within the area in green;

- For up to 30 years, 7 percent of the city's current 9 percent transient guest taxes (less any state administrative fees) with respect to sleeping accommodations in any hotel, motel, or tourist court located within the area in green.

The proposed ordinance would exclude revenue from the city's street maintenance sales tax (.375 percent), park sales tax (.125 percent) and "any other retail sales and compensating use taxes that are committed to other uses by election of voters, any sales taxes generated by existing or future special taxing districts aside from the proposed district (e.g., community improvement districts, tax increment financing districts, or transportation development districts), incremental transient guest tax revenue produced from a levy exceeding 7 percent not already pledged within any existing tax increment financing districts, and all revenue produced outside" of the area in green.

The revenues would be contingent on the team locating its headquarters within the area in green and the issuance of bonds by a governmental issuer to finance the STAR Bond project by Dec. 31, 2030.

"No full faith and credit bonds will be issued by the City to pay the costs of the STAR Bond Project," city staff said in the proposed ordinance. "In no event will the Bonds be deemed to constitute a debt or liability of the City, and the issuance of the Bonds will not obligate the City to levy any form of taxation or to budget or make any appropriation for the repayment of the Bonds."

—