KSHB 41 reporter Olivia Acree covers portions of Johnson County, Kansas. Share your story idea with Olivia.

—

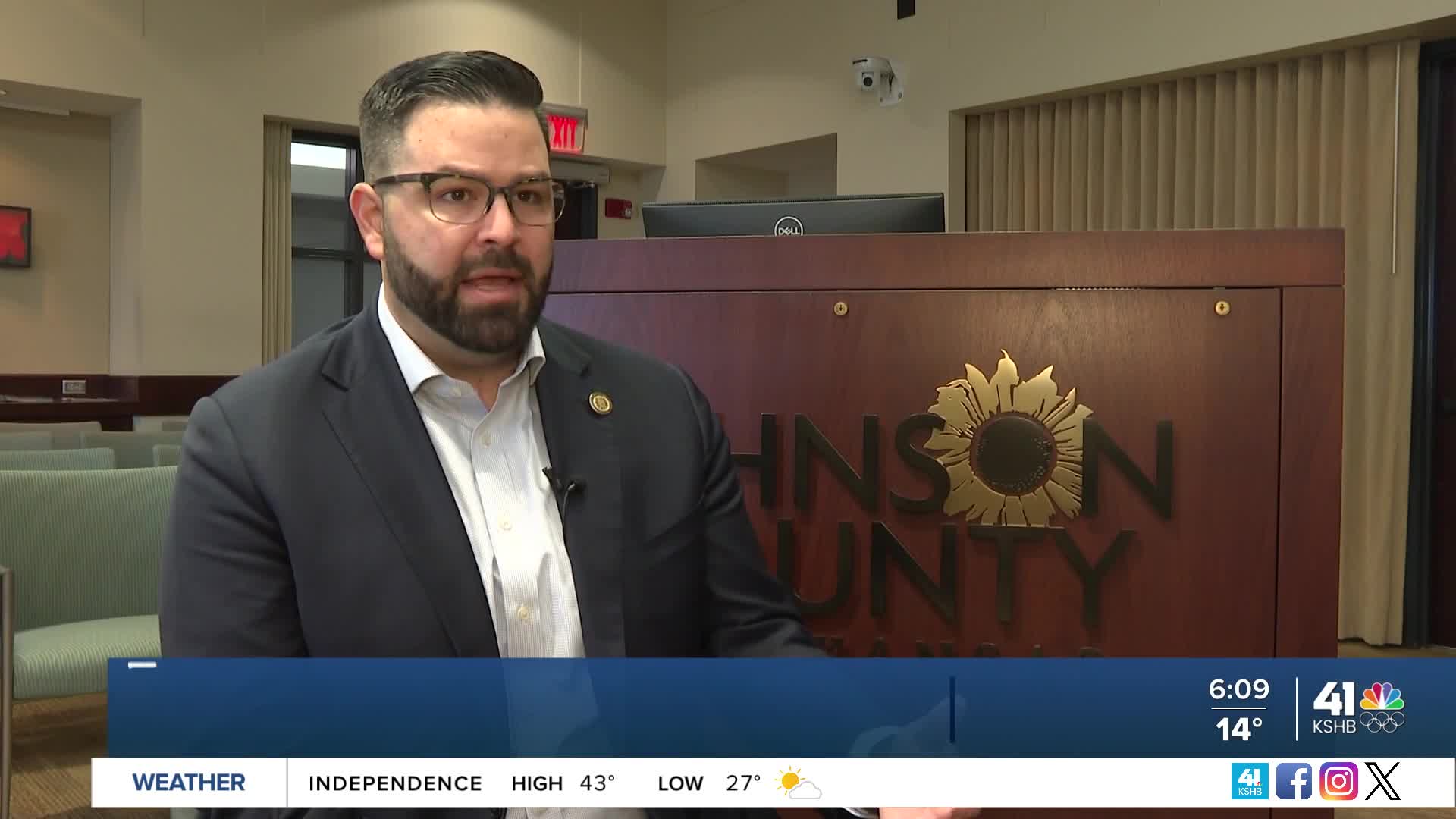

Johnson County leaders are reassessing their approach to public safety funding after a judge ruled against placing a proposed sales tax extension on the March 2026 ballot.

The county had planned to extend an existing sales tax, which would have generated approximately $52 million annually for public safety services for another 10 years.

However, a Shawnee County judge determined the measure didn't meet state law requirements, ruling the tax could only fund specific law enforcement facilities rather than broader services, like EMS and mental health programs.

"We believed that public safety means more than just law enforcement," said Mike Kelly, Johnson County Board of Commissioners Chairman. "Public safety means EMS to me, public safety means mental health. These are essential to an ecosystem of safety within our community. So clearly, the judge disagreed."

County commissioners removed the proposal from the ballot, but Kelly says the funding need persists as service demands continue growing.

"We still have increasing call volume for EMS. We're up 70% over the last 10 years, and those numbers continue to rise," he said. "The costs to be able to provide these fundamental services continue to increase."

County officials preferred using the existing sales tax structure to avoid impacting property taxes. With the current sales tax set to expire in March 2027, leaders are now considering alternative funding means.

"There's only so many ways that we can take meat off of the bone, and so when that becomes the choice of sales tax or property tax, we want to balance that in a way that meets the demand of Johnson Countians," Kelly said.

As the county develops its 2027 budget, officials are exploring options, including another sales tax proposal, service fees or property tax increases, which leaders view as a last resort.

This story was reported on-air by a journalist and has been converted to this platform with the assistance of AI. Our editorial team verifies all reporting on all platforms for fairness and accuracy.

—